UK celebrates tenth anniversary of contactless payments

It’s been ten years since contactless payments were first launched in the UK. The revolutionary payment method has been adopted across the country, allowing businesses and consumers alike the ability to save time at the checkout.

Over the past ten years, more than £60 billion has been spent using contactless technology. 60 per cent of UK consumers now choose to pay using contactless technology. This is predicted to rise a further 317 per cent over the next four years.

During this time, new technological advances have allowed contactless payments to become even more accessible.

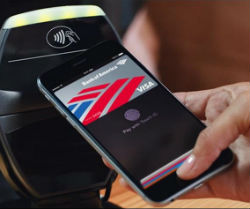

With the introduction of mobile wallets, consumers can now tap to pay using a mobile phone or smart device. The majority of smart devices now support digital wallets, with Apple Pay, Android and Samsung all providing their own variation.

When first launched in 2007, consumers were restricted to the amount they could spend on a contactless device. Maximum spend was capped at £10, allowing only small purchases to be made.

Over the years, the contactless spending limit has increased. It now stands at £30, with over half of eligible transactions made using the tap and go method. Many business owners and consumers are looking forward to further increases to this limit.

One of the business sectors taking the highest number of contactless payments is the hospitality industry. Around 90 per cent of transactions under £30 in fast food chains, pubs and bars and now made using contactless.

Accepting contactless payments is now vital for independent businesses. More than half of eligible transactions are now made using the technology.

All Handepay terminals are equipped with contactless technology. There’s no set up process, you can start taking payments from contactless cards, mobile wallets and smart devices straight away. To find out more speak to one of our friendly advisors today!

Would you like

a callback?

FIND OUT MORE

Talk to an advisor today...