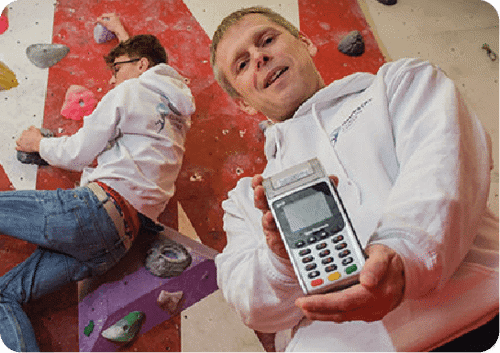

All the payments you can accept with a contactless card reader

Contactless payments are much more than debit and credit cards today. Here’s all the payments you can accept by using a contactless card reader.

The number of payments in the UK made using contactless card machines has increased more than ten fold in the last five years, from 43.5 million in 2015, to 519 million in June 2020 - according to the latest payments data from Statista.

Whenever you think of contactless payments, contactless credit and debit cards come to mind.

These are the predominant type of contactless payment method in the UK.

But they aren’t the only way to accept a payment on your contactless card reader.

Payment technology is changing quickly.

It’s important to make sure your card reader is set up to accept all types of payments, contactless or otherwise.

If you’re not sure how using a contactless card machine can make your business future ready for the next wave of payments tech, here’s a quick guide to the type of payments you can accept with your card reader.

Contactless debit and credit cards

It’s undeniable, contactless payment use is increasing every year.

It’s fast, simple and safe.

Contactless card use was already on the rise, but it’s skyrocketed following the events of 2020.

Payment hygiene and speed of transaction are important in the wake of a global pandemic, with the Government and WHO recommending contactless card machine payments.

Contactless payments allow your customers to pay in seconds with a quick tap on your card reader.

If you don’t have a contactless card machine, you’re restricting your safe payment options.

Chip and PIN

This is now seen as the “traditional” method of paying by card, replacing the old mag-stripe swipe to pay in 2003.

It’s faster and more secure than paying with cash.

But customers still have to touch your contactless card reader to enter their PIN.

Not to mention remember they’re PIN.

For those customers who haven’t made the switch to contactless, or for card payments over £45, Chip and PIN is the standard.

The great news?

With a contactless card machine, you’re not limited to contactless payments.

You can accept Chip and PIN transactions too.

Mobile payments

Payments using smartphones made up nearly 20% of all mobile payments made by customers in 2020.

Many consumers today have their bank account linked to a digital wallet like Apple or Samsung Pay.

These work in a similar way to contactless cards, a quick tap at the till and your customers can be on their way.

In addition to speed, they’re also secure. Each payment is authorised using biometrics, such as thumbprint or facial recognition.

With smart devices a common part of modern life (about 84% of British adults own a smartphone), it is expected that mobile payments will continue to grow.

A contactless card reader can help future proof your business by allowing you to accept the latest payment methods.

Why should you accept these payment methods?

If you’ve been accepting cash, or even chip and PIN, and don’t think you’d see any benefits from switching to a contactless card machine, there are some huge benefits you could experience which not only improve your customers’ experience, but make your business more profitable.

Some of the main benefits are:

- Serve customers quickly: Don’t waste time waiting for or counting change. Customers can simply tap and go.

- Serve more customers: As each transaction is shorter using a contactless card machine you can keep queues moving and serve more customers during the day - which equals more sales for you.

- Less risk of fraud: Contactless card machines create a transparent audit trail of your transactions so you know exactly what you’ve taken and how much has gone into your business’ account. No more risk of taking forged money. Plus, payments are only authorised if the customer has funds available, so you know you’ll get paid.

- Customers are moving towards contactless: All the stats show that customers are becoming more comfortable with contactless. Those who had never used contactless cards before this year now say they are happy to use contactless and don’t imagine themselves going back.

- Future proofing your business: Payment technology is moving further away from cash. We’re now at a stage where customers can pay using their smartphone, or any mobile smart device. Younger shoppers in particular are a cashless generation.

Want to start using a contactless card reader for your business?

Get in touch to find out more and see how quickly you can be up and running with contactless payments.

Already got a card machine supplier?

Take the Handepay Price Challenge today.

We’ll show you how much you could save by switching to one of our contactless card readers.

If we can’t beat your current deal, we’ll give you £1,000.

Tens of thousands of businesses have taken the challenge so far.

We’ve been beaten less than 1% of the time.

What do you have to lose?