![]()

Business Finance provided by Funding Circle

Take control of your future with the Handepay Loyalty Programme.

We are pleased to announce a new partnership between Handepay and Funding Circle, increasing the capability of the Handepay Business Finance scheme.

By clicking here you will be redirected to Funding Circle’s website to start your application.

Why Funding Circle?

Funding Circle offers SMEs access to business finance at competitive rates and have helped over 130,000 businesses borrow a cumulative £14.5 billion to take their business further through a process that is fast and efficient with full support available from start to finish.

By clicking here you will be redirected to Funding Circle’s website to start your application

Am I eligible?

To get a loan with Funding Circle, you'll need to meet the following eligibility criteria:

1. Be a UK based limited company (Ltd) or limited liability partnership (LLP)

2. Be actively trading with at least 1 year’s trading history.

For more information or to discuss a potential application you can contact Funding Circle’s Partnerships Team at [email protected].

As they value your time, Funding Circle have streamlined their loan application process to be fast and efficient. Unlike some other lenders, in Funding Circle’s application process there is no need for:

In-person interviews, business plan reviews or financial forecasts!

It really is super easy…

By clicking here you will be redirected to Funding Circle’s website to start your application.

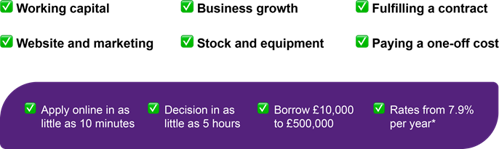

The Benefits

To help more businesses get fast, affordable access to finance,

Handepay and Funding Circle are officially partnered together.

By clicking here you will be redirected to Funding Circle’s website to start your application.

* 7.9% rate not guaranteed and may be higher. Each borrower’s rate is determined by Funding Circle at time of lending offer, based on Funding Circle’s criteria.

All loan applications are processed and provided by Funding Circle Ltd. Loan applications submitted through referral by Handepay shall be for incorporated entities only, and as such, the loan agreement will not be subject to the regulation and legal protections available to loans that are consumer credit or regulated mortgage contracts. All loans are issued with a personal guarantee provided by at least 50% of the borrower’s shareholding.

Any funding offered by Funding Circle is in the form of an unsecured term loan that must be taken for the benefit of the applicant business.

Please see the Funding Circle privacy policy and FAQs for more information.

Handepay’s activities in relation to the Funding Circle products are in respect of incorporated entities only, and do not constitute regulated credit broking.