How to Start Taking Card Payments

With the rise of contactless cards, mobile phone payments, and even smart watches, consumers have more ways to pay than ever before. Because of this, more and more people are choosing to ditch cash.

In this guide, we’ll explain why it’s time to consider taking card payments and show you just how easy it can be.

We’ll show you a step-by-step process of how to take card payments and outline all the different payment options.

Quick Links

> Why start taking card payments?

> How do card payments work?

> How can I take card payments for my business?

> Step by step guide of how to take credit card payments

> What is the best way to take card payments?

> The benefits of a merchant account

> Is it secure to take card payments?

> How much does it cost to take card payments?

> Card payment terms to know

> Start taking card payments

Card payments are now more popular than cash. So, if you’re not already taking card payments, the chances are that you’re missing out – and so are your customers.

For a start, you’re missing out on sales opportunities. One in ten UK adults choose to live a largely cashless life (making just one cash payment per month, or even none at all), according to research by UK Finance.

To put it simply, the use of cash is declining while the use of cards is rising. According to UK Finance, cash will make up just 9% of transactions in Britain by 2028.

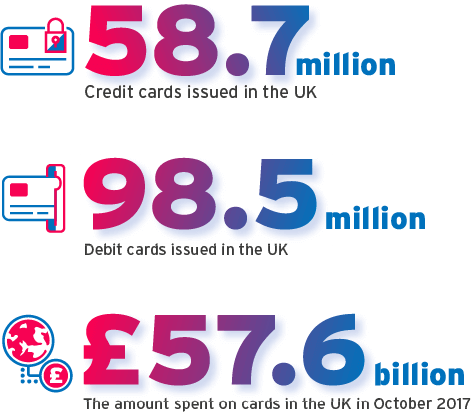

With debit and credit cards now the two most popular (and most common) forms of payment, it is a smart business move to make sure your customers can pay this way.

Beyond the rise of cards, there are other benefits too – for both you and your customers. Card is often preferred because of its convenience. Allowing a customer to simply tap their card for payments under £100 makes the process less painful for everyone – no more counting coins for either party. The removal of cash makes the transaction more convenient, more hygienic and more secure.

Once you introduce card, you can see your queue time reduce. This frees time up and also increases your customer satisfaction.

How do card payments work?

Card payments are so simple for you and your customers. But, what’s going on behind the scenes to make the magic happen? There are several parties involved which form part of the journey:

Your customer – the person making the payment (also called the ‘cardholder’)

Your company / you – the business making the sale (also called the ‘merchant’)

Your payments company – the company who supplies you with a card machine, processes your payments and puts the money in your bank account. This may be a high street bank (e.g. Barclays, HSBC, Santander, etc.) or an ISO provider such as Handepay.

Your customer’s card scheme – the payment network the customer’s card is connected to (e.g. American Express, Visa, Mastercard, etc.).

Your customer’s bank – the bank that has issued your customer’s credit or debit card (also known as a ‘card issuer’)

The acquirer - is responsible for receiving the card transaction details from the merchant’s terminal, passing these through to the card issuer via the card scheme for authorisation. This is how the transaction ultimately gets completed.

A card payment happens in three stages:

1. Checks (also known as ‘authorisation’)

If a customer used their credit or debit card to pay you, your merchant services provider (e.g. Handepay) would send the payment request securely to your customer’s card scheme (e.g. Visa).

Card schemes connect merchants’ payments companies to customers’ banks. So, the card scheme will check your customer’s bank to make sure they have enough funds to make the purchase. If they do, the payment will be authorised. If they don’t, the transaction will be declined.

2. The sale

As long as your customer’s payment is authorised, the money for their purchase is taken from their bank and then held for you by your merchant services provider.

3. Settling up

Usually, a merchant services provider will release the money they have been holding at the end of each working day.

This money will normally arrive in the business owner’s bank account in no more than 3 working days - although most providers will offer next banking day settlement.

Merchant service providers will charge standard fees for each sale. These will usually be billed each month and can be paid simply by Direct Debit, so you don’t even need to remember to do anything.

Once all fees have been paid, every part of the payment process is complete.

How can I take card payments for my business?

There are several stages to taking card payments, with a majority of this happening in the background and handled by payments companies, card schemes and banks.

All you need to do is get set up. And, as you’ll find out, it can be surprisingly easy.

How can I take payment with a card machine?

All you need to accept debit and credit card payments is a merchant account, along with a card machine that’s registered with a merchant service provider. It’s really that simple.

Once you have a card machine and merchant account ready-to-go, your customers can insert (for Chip and PIN), tap (with a Contactless card, or an e-wallet like Apple Pay) or even swipe (usually only for international issued cards without a chip) their cards to complete their payment.

Your card reader will either be connected to the internet on its own, via roaming SIM card (for mobile terminals), or even over the phone line. Thanks to this online connection, the card payment process can begin.

How can I take payments online?

To do this, you’ll need an eCommerce platform that supports a secure checkout system.

There are all-in-one solutions available which include a built-in secure gateway. With other payment solutions, you may need to have a separate gateway to process and accept payments online.

Payment gateways protect customers by encrypting their information and sending it over the internet safely and without compromise.

Once this information has been sent, a similar payment process in comparison to face-to-face transactions will begin.

In 2018, internet sales represented 18% of all retail sales in the UK (according to the Office for National Statistics). With almost 1 in 5 transactions now taking place online, retail businesses need to seriously evaluate the digital opportunity. If you think you could benefit from selling on the internet, you’ll need to be able to accept card payments.

How can I take credit and debit card payments over the phone or by mail order?

The merchant is responsible for manually entering the customer’s card details into another payment system. This could be your independent card reader, or an online virtual terminal.

An alternative approach is taking a mail order transaction - which results in emailing a customer the invoice. They would then use the online payments system themselves. The issue with this method if that customers who order by phone often wish to pay this way, so they may not be able to navigate an online virtual terminal (or even have internet access to do so).

As there are several ways to accept card payment over the phone, it all depends on what would suit your business needs best.

Step by step guide of how to take credit card payments

So, you want to start taking card payments. Before you do this, you need to find the right merchant services provider for you.

These are the steps we recommend going through before making your decision:

Step 1:

Understand the card payment option

You can take card payments in different ways – face-to-face, online or over the phone. You need to think about how and where you want to take payments before you make any decisions.

The chances are if you run a physical location, you’ll want people to be able to make a card payment in person. Simple. However, even with this, you should still think about practicalities such as understanding whether you will need multiple card machines for multiple locations, or a portable card terminal to be taken to your guests (i.e. if you run a restaurant).

If you’re running a business online, offering a card payment option on your website is vital to making sales.

Or if you receive orders over the phone or by mail order, you’ll want to consider the method of processing phone payments that it is going to work best for you and your business model.

Step 2:

Find the right merchant account provider

Once you’ve established how and where you want to accept card payments, you need to think about who you’d like to accept these with.

When choosing your payment provider, there are a variety of things you may want to consider.

These include:

• Customer service – If you have a problem, are you confident it will be resolved?

• Costs – Different merchant service providers charge different transaction fees

• Speed of settlement – Some may settle up faster than others.

• Trust - social proof is a powerful factor. You can gauge this by exploring their customer reviews.

• Technology - can the provider equip you with the best technology? Contactless terminals especially are a must nowadays.

Step 3:

Choose the card payment option to suit your business

Your decision will be down to your personal preference, and influenced by your own unique needs (such as volume and size of transactions).

You should also consider the card machines available. Do you want to be able to take card payments on the go? Or are you OK with one fixed machine? Thinking about this, alongside the initial cost of devices, can help you make the right choice.

Step 4:

Decide how you'll factor card transaction fees into your operating costs

You need to think about who will pay for your card transaction fees – is it you, or is it your customer?

Transaction charges don’t always have to eat into your bottom line. Some businesses will choose to swallow the cost, considering it a fair trade-off for the growth that is brought to them thanks to the convenience of card.

Before you implement card payments, you need to consider what you’re most happy with – and what your customers will agree to, too.

You need to weigh up your options and think about what will benefit your business the most in the long term.

Step 5:

Start accepting card payments

Once you’ve worked out all the logistics and processes, you’re good to go.

If you have a new card machine, make sure your customers know that it’s there. Some providers might provide you with decals to stick in the windows and doors of your business just to show that you accept cards.

And if you’re newly accepting card payments online, let people know of this too.

You want those who may have previously been put off by your cash-only policy to know that they can now pay with their preferred methods hassle-free.

Step 6:

Reap the rewards

After you’ve started taking card payments, the next step is to receive your money.

As explained before, how long this takes will depend on your merchant services provider’s timescale.

What is the best way to take card payments?

The best way to take card payments depends on your own unique business needs.

Every way to take card payment is the ‘best’ for someone.

Consider your business type first, and then choose the card payment method that will best suit you:

• Shop – If you run a brick and mortar business, an in-store card payments system will help you serve customers at your till.

• Restaurant & bars – Similar to shops, you’re going to want people to be able to pay in-person. However, flexibility is more important. If you want to be able to take the card reader to customers at their tables, you’ll need a portable device

• Market / street vendor – If you sell to customers but you are on the go, you can still offer the convenience of card payments. You just need a portable device that is internet-connected. Sorted.

• Online business – When you’re competing with the vast range of products available on the internet, you want to give your customers a smooth buying experience. Offering card payments online means people can complete orders quickly and easily.

• Mail order – Perhaps you run a catalogue? If you do, you may want to consider processing card payments over the phone. How you decide to do this (i.e. entering their details for them online, or manually into a card reader) is entirely up to you.

The benefits of a merchant account

A merchant account is essential in enabling your business to do the following:

• Accepting credit and debit cards – Sounds obvious, of course, but a merchant account enables you to accept a wide variety of credit and debit cards

• Increase revenue – By accepting more payment types, you also increase the amount of customers who will buy from you. This, in turn, will increase revenue

• Raise customer satisfaction levels – With the convenience of card, you can keep your customers happy by giving them the choice to pay this way

• Boost productivity – With card payments, you can serve more customers in less time. This means queues can be reduced and staff can be more efficient

• Improving money management – Accepting card will streamline the way your business handles money. Operating as cashless improves the security of your physical location and also ensures better cash flow management

• Meeting customer expectations – You can’t accept card payments without a merchant account, so you need one in place to meet customer expectations as a bare minimum.

• Increasing high-value purchases – Consumers are more likely to make larger purchases via card - and you need a merchant account to accept cards. You could also argue that the same applies to impulse buys.

Is it secure to take card payments?

Taking card payments is secure for both businesses and customers. All merchants who accept card payments (whether online or offline) must comply with the

Payment Card Industry Data Security Standard (PCI DSS).

The PCI DSS is a framework of 12 technical and operational requirements set out by the PCI Security Standards. All merchants who store, process or transmit

card payment data need to be fully compliant with these standards.

This framework is designed to cover things such as:

• Protecting cardholder data

• Keeping all online systems safe from malware or viruses

• Maintaining secure systems and applications

• Ensuring security policies are in place

As long as you are compliant with the PCI DSS, you can be confident that it is secure to take card payments. It’s worth noting that there is likely to be some charges

for this, though.

Many providers will charge in order for you to become PCI compliant. If you don’t pursue this route, you’ll also want to bear in mind that there are also charges

for non-compliance.

How much does it cost to take card payments?

The costs of taking card payments varies. This may be due to the volume, type and average transaction value (ATV) of transaction you’re processing, as well as the fees your merchant service provider chooses to charge.

The different fees and costs you may incur will generally fall into these categories:

• Transaction fees – Also known as ‘merchant service fees’, there are various fees that this could relate to. The most common one to look out for is the flat-rate fee or a percentage of each transaction. The amount you are charged will depend on the agreement with your payment provider. The charge may also vary depending on the type of transaction (e.g. you may be charged more for credit cards compared to debit cards).

• Set up fees – Usually a one-off fee to cover the cost of setting up a new account

• Card machine, or service rental fees – either a one-off fee for purchasing a card machine or ongoing service rental fees

• PCI DSS compliance fees – As explained above, some providers might charge you in order to gain PCI status.

• Minimum monthly service charge (MMSC) – This is the minimum fee charged if you don’t meet the number of monthly transactions agreed between you and your provider.

• Card not present (CNP) fees – there are often additional charges for some of the security features required for CNP transactions.

• Miscellaneous fees – There are some other fees that you may come across, such as when there is a disputed cardholder transaction (also known as a ‘chargeback’), or early cancellation fees if you’re tied into a contract and leave this before it ends. You will also pay a transaction fee for refunds issued.

Card payment terms to know

Here is our glossary of commonly used (and often confusing) terms and phrases you’re likely to hear:

• Card scheme – This is the type of payment card, such as Visa, Mastercard, Maestro

• Issuer – The bank that provides / issues the credit or debit card

• Merchant account – This is the account you use to process card payments, as provided by the acquirer (regular bank, all-in-one provider, or a merchant services provider)

• Payment gateway – This is what connects your website’s checkout payment to the payment processing solution - a virtual terminal. All-in-one online services, such as PayPal, include a payment gateway within their service. Others work separately and would require a separate payment gateway account

• PCI compliance – The Payment Card Industry Data Security Standard (PCI DSS) set out guidelines that all those who take card payments should follow. PCI compliance means these guidelines are being followed

• Processing fees – These are what the merchant account provider will charge. These will vary per provider. They are usually per-transaction but some acquirers may also charge a monthly fee

Would you like

a callback?

FIND OUT MORE

Talk to an advisor today...