Boost your profits by accepting online payments

Research reveals nearly nine in ten independent businesses expect to accept online payments by the end of next year, with digital sales set to rise from 64 per cent to 88 per cent by 2018 according to Amazon.

The rise in businesses planning to use e-commerce in 2018 is said to be motivated by the growth in business owners planning to start selling via their own website (rising from 50 per cent to 68 per cent) and mobile apps (increasing from 13 per cent to 24 per cent), if they have one. The research also suggests that businesses who use e-commerce expect to see faster revenue and job growth next year.

Doug Gurr, Amazon UK country manager says, “The contrast in performance between businesses who use e-commerce and those that don’t is significant, so it’s reassuring for the UK economy to see small businesses investing in digital,”

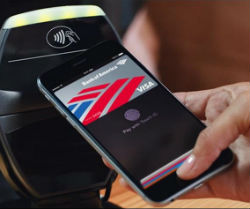

Allowing your business to accept online payments can help to create maximum exposure. To survive in today’s market, it is essential to adapt to new technologies and the way people are spending, therefore, moving your business online and becoming mobile responsive is key. By doing this you can reach more customers and widen your overall customer base, at the same time increasing your profits by making your goods and services available 24 hours a day, 7 days a week.

Setting up and running an e-commerce website is easier than you think and with Handepay you can accept payments online for as little £9.99 a month. Handepay offer simple online pricing plans with no hidden fees as well as dedicated service and support to get you up and running.

Discover how accepting payments online can make a difference to your business today by getting in contact with one of our advisors.

Would you like

a callback?

FIND OUT MORE

Talk to an advisor today...