Android Pay available in the UK

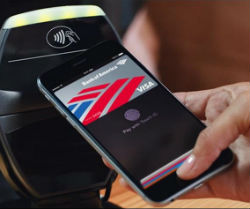

Users of Android smartphones will now be able to pay using their digital wallet stored on their phone in shops and on third-party apps.

Released as a competitor to the existing Apple Pay platform, Android Pay will allow more people to pay quickly and simply, without the need for a physical wallet.

With reports revealing that 60% of smartphone users in the UK own an Android handset, Android Pay’s launch could see a sharp increase in the number of mobile contactless transactions.

The platform has the same maximum spending limit of £30 as Apple Pay, however Android have stated that by upgrading terminals, business owners can choose to accept higher amounts in the future.

Differing from Apple Pay, the new launch from Google will also offer incentives for Android customers to pay using their smartphone. The company is launching a monthly promotion named “Android Pay Day”, allowing users access to discounts on the Tuesday before payday.

Benefits such as discounted coffee from Starbucks, and reduced price takeaway food from Deliveroo are amongst the initial offers announced, with Google promising more offers to come.

Banks that are supported on the Android Pay platform are Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA and Nationwide Building Society. Barclays customers will not be able to use the app, as Barclays are launching their own product to compete in the digital wallet landscape.

All of Handepay’s terminals support Android Pay payments, alongside Apple Pay and contactless cards. Find out more to see what your business could save.