Contactless Payments Explained: how do they work, what are the payment limits and how safe are they?

Contactless payments are becoming more popular by the year. UK Finance forecasts that 37% of all purchases will be contactless within the next 10 years.

Whether you’re comfortable with contactless payments yet or not, it’s normal to have plenty of questions. So, we created this guide to clear up everything you need to know.

If you want to skip ahead to a particular section, click any of the links below.

Let’s get started…

Quick Links:

> What is a contactless payment?

> How does contactless work?

> How do contactless cards work?

> How do I make contactless payments?

> What is the contactless payment limit?

> Using contactless

> How safe is contactless payment?

> The advantages of contactless payments?

> The disadvantages of contactless payments?

> Start taking contactless payments

What is a contactless payment?

A contactless payment is a simple way to pay in-store for goods priced £45 or under. It is a faster alternative to paying on a card machine via Chip and PIN. A number of devices can be used for contactless payments, including cards and certain smart devices.

How does contactless work?

If you have a contactless device, you simply hold it near a contactless terminal to pay. Sometimes, you may need to tap the device against the terminal itself.

As long as the price of your purchase is £45 or under, the transaction takes place just like that.*

On the odd occasion, the transaction may not be successful. This can be for security reasons, to make sure that someone else isn’t using your card.

If this happens, you can insert the same card debit/credit card into the reader and enter your PIN to pay.

*Some retailers and contactless devices allow purchases of a different limit.

Learn more about contactless limits further on.

How do contactless cards work?

There is an antenna inside every contactless card that sends out radio waves, and every contactless terminal emits an electromagnetic field. When your card enters that field, the two devices connect to process the purchase information.

The technology works off radio frequency identification (RFID).

A similar technology, near-field communication (NFC), is used in alternative contactless devices (like iPhones).

Contactless payments with my credit/debit card

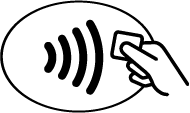

Make contactless payments with your debit/credit card by first ensuring the card is contactless-enabled. You can check by looking for this symbol on the card itself:

If you have the symbol, you are good to go. You just need to make your first purchase using Chip and PIN, which unlocks the contactless capability.

If you don’t have the symbol, you can request a new contactless card from your bank. You should then receive the card in the post - along with an activation phone number (some banks welcome you to activate the card in-branch).

Note: Not all in-store card readers will be able to process contactless payments. In cases like this, you can still use your contactless card via the Chip and PIN method.

Contactless payments with my phone

A contactless mobile payment is made by holding or swiping your phone near a compatible terminal.

Only certain phones support contactless payments via specialist apps. The technology and process is similar across them all.

Whatever route you go down, it’s important to follow all of the instructions - which are designed to optimise the experience and keep your details secure.

Below, you can see a shortlist of the most common routes for contactless mobile payments.

If your Android device is equipped with NFC technology and has its operating system up-to-date (Android Lollipop 5.0 or higher), you’re almost there. Next step is to download your payment app.

The Google Pay app is supported by the majority of major UK banks and is free to download.

Once you’ve got the app, you link your credit/debit card to your Google account, and you’re set to use it for contactless payments. Just open your “virtual wallet” on the phone, select the card you wish to use, and hold it near the contactless terminal to pay (works just like a plastic contactless card at this point).

If you’d like to learn more about how Google Pay works, go here.

Note: The Barclaycard app and Android Contactless Mobile is a dedicated service for Barclaycard customers. It syncs your Android phone to your Barclaycard account, and card, to enable contactless payments.

If you have an iPhone 6 or newer, and your iOS is up to date, you can set up Apple Pay no problem.

Just add your credit/debit card to the Wallet app (comes as standard on the iPhone).

When it comes to paying at a terminal that accepts mobile contactless payments, double tap the side button to open the Wallet. Check the correct card is selected. Then hold the top of your phone close to the terminal.

You’ll also need to hold your finger on the Touch ID button (this is an extra security measure).

Apple introduced Face ID to Apple Pay in 2017. If you’re using this, then you don’t need to hold the Touch ID button when paying. Instead, you glance at the screen when prompted, the phone recognises your Face ID, and authorises the card to be used for payment.

If you want to learn more about Apple Pay, visit this guide.

Samsung Pay is compatible with the Samsung Galaxy S6 (and all its variants), the Samsung Galaxy Note 5, and all newer Samsung smart devices.

Once you’ve got the app, you can add as many credit/debit cards as you like.

With a card added to your Samsung Pay app, you can use your device to pay using contactless at compatible terminals - just take the phone off standby by pressing the home button, and hold it near the reader.

This app is exclusive to Samsung phones and comes with a couple of differences to the other methods. If you want to understand more about Samsung Pay, click here.

It’s worth noting that more and more contactless devices are sprouting up as the payment method increases in popularity. For example, FitBit -- the brand behind the wearable fitness tracker -- have also entered the market with FitBit Pay.

For the most part, the technology works in much the same way across any contactless device/app, as does the way you pay with them.

The main difference to look out for is the banks that support the provider. The reputable providers often publish a list of the banks supporting their product.

As with contactless cards, a payment with your mobile device can sometimes be unsuccessful. You may then be required to pay using Chip and PIN instead. There are various reasons why a contactless payment could be unsuccessful, such as your handset’s operating system needing an update.

What is the contactless payment limit?

As of April 2020, the contactless card limit in the UK is £45 per transaction (known as the “floor limit”). If your purchase comes to more than £45, you’ll need to pay using Chip and PIN.

There is no limit on mobile contactless payments that require two-factor authentication (such as Apple Face ID).

Limits, and rules associated, are also subject to your bank and/or the country in which you are paying.

What is the daily limit for contactless payment?

There is no daily limit on how many contactless payments you can make. But according to rules updated by the EU in 2019, you are required to enter your PIN after every five consecutive transactions in a 24 hour period, or if the total value of consecutive transactions exceeds 150 euros.

This is to make sure that you’re still in possession of your card, and it’s not been stolen and used fraudulently.

Where can I use contactless payments?

Contactless payments are accepted in many shops, restaurants, pubs, and cafes. You can also pay using contactless for certain modes of public transport. The merchant’s terminal will display the following symbol if it accepts contactless payments:

Some terminals will also display the Apple Pay, Google Pay, or Samsung Pay logo to indicate mobile contactless payments are accepted, too.![]()

Sometimes, the retailer will use signs/stickers elsewhere in the store, featuring one or more of these symbols, to further promote that they accept contactless.

The same goes for certain automated services like car parking paypoints or vending machines.

Can you use contactless on the London underground?

Yes, you can pay contactless for the London Underground - just like when using an Oyster card. Just hover your contactless device over the yellow receiver at the turnstile and the gate will open for you.

Do this on your way in and out of the underground. The two “touches” indicate the start and end of your journey. You’ll be charged a standard adult rate.

Remember, if you’re making multiple trips throughout the day, the card may not work after five transactions - meaning you will need to purchase a ticket as normal.

For more information about how contactless payment works with the London Underground, visit the Transport for London website.

Other underground and rail services across the UK are starting to use the same contactless system - so it’s worth checking at your local station.

Can I use contactless to withdraw cash?

If you are a Barclays card holder, you can use your connected contactless device to withdraw cash at any Barclays ATM displaying the contactless symbol.

This may become the case with other card providers and ATMs in time - and some have trialled it already.

Remember, you can still use your contactless card to withdraw cash at a non-contactless ATM via the Chip and PIN method.

Can I use my contactless card abroad?

Yes, you can use your contactless card abroad - providing the merchant displays the contactless symbol.

The transaction limit of £45 still applies - unless the country/merchant has their own floor limit in place.

Of course, the exchange rate comes into play here, so it won’t always be as obvious if your purchase is within limit. Some countries will also apply an extra charge for making a foreign payment (same as with Chip and PIN).

If the payment is rejected, you can pay (with the same card) using Chip and PIN.

Why was my contactless payment rejected?

The most likely reason for your contactless payment being rejected is that your purchase exceeds the transaction limit. It could also be due to an extra security measure that requires you to occasionally pay via chip and PIN.*

More reasons include:

- The device is not activated correctly

- The card has expired

- The connected account has insufficient funds for the purchase

- The card is damaged

- The operating system on your contactless mobile device is out of date

*The EU rules were updated in 2019- stating that for every five consecutive contactless transactions in a 24 hour window, you will need to re-authenticate the card by paying via Chip and PIN. The same action is required if your totalled payments exceed €150.

Sometimes, the merchant’s terminal won’t display a prompt for the Chip and PIN - simply rejecting your payment instead. So, if you’re confident that none of the other reasons above are valid, try inserting your card and paying in the more traditional way.

It’s worth knowing that there are some exceptions to this rule - allowing you to pay contactless as normal at certain automated car park terminals, for example, despite the number of consecutive transactions.

Also, if your contactless device already comes with an extra layer of authentication (like Apple Face ID), the rules may not apply.

Will I be charged extra for using contactless?

No, you should not be charged extra for using a contactless payment.

Do you get a receipt with contactless payment

Contactless payments typically don’t prompt the automatic printing of a receipt. But you can always ask for one from the merchant you are paying. As it’s effectively a card payment, the transaction will also show up on your bank statement.

Can I opt-out of having a contactless card?

With select UK banks, it is possible to request a non-contactless card, whereas others do not provide anything but contactless cards. It’s best to contact your bank to find out. You may need to switch your account to a bank that still provides the non-contactless option.

How long do contactless payments take to process?

It’ll typically take 2-3 working days for a contactless payment to come out of your account and show up on your statement. So, it makes sense to keep track of your contactless payments to ensure you have enough funds to cover each transaction.

There are a few reasons for the delay but, with contactless purchases being of particularly low value, it’s usually because the terminals can process the payment as “offline”. This means your bank needn’t be contacted by the device for the transaction to take place.

It shortens your time at the checkout...but it also means your payment information isn’t sent to the bank instantly.

How safe is contactless payment?

Contactless payments are safe and secure - providing you take care (as with any bank card) to avoid the known risks.

Let’s take a closer look at the most common concerns below…

Is Chip and PIN safer than contactless?

Contactless payments are protected at the same level as Chip and PIN payments,

according to the UK Cards Association and Visa.

There are security measures built-in to the contactless payment method:

- Contactless devices only work within approximately 4cm or less from the terminal - minimising any risk of an interception of data during its transmission

- As soon as the total spend of consecutive purchases reaches 150 euros, the user is required to enter the PIN - limiting the damage to that cash amount if the card is stolen and used by a fraudster

- The PIN is also required for every five transactions made

- If the card is lost or stolen, and you report it to your bank immediately, you will not be charged for any purchases made by the fraudster

- For mobile contactless payments, further identification is often required to activate the purchase - such as fingerprint ID, PIN protection, or even facial recognition

- All payments made on a contactless card are tracked on your bank statement for added security

Can a contactless payment go through twice?

No. Terminals don’t take more than a single payment from a single card, for any single transaction. As soon as your device has connected with the terminal to pay for the purchase, the transaction is complete. Only then can another transaction take place - which would require input from the merchant to initiate.

Your payments will show up on your statement. To further mitigate any risk in this area, ask the retailer for a receipt each time you use contactless to pay.

Could I make a contactless transaction by accident?

Technically yes, but it’s difficult to make an accidental contactless payment. The card typically needs to be within centimetres of a reader to connect and pay. There also needs to be a transaction already cued for processing on the cashier’s unit for a payment to take place.

A risk known as “card clash” refers to when you tap more than one card on a reader at the same time - the concern being all cards are charged at once. A security measure built-in to the terminals prevents this - rejecting all payments if multiple cards are used together.

Reports from Transport for London do indicate that “card clash” is possible on the automated paypoints for the Underground. You may run into a similar situation at other automated paypoints - so take care.

Can contactless cards be skimmed?

Yes, a contactless card can be skimmed for certain details - but those details may not necessarily allow fraudsters to spend your money.

According to Visa, it is not possible for details, such as your 3-digit CVV code or PIN, to be read from a “bogus terminal”.

It’s worth remembering that some websites do not require you to enter a CVV code to make a purchase and so there is a fraud risk there.

However, in 2019, UK Finance stated that “No contactless fraud has been recorded on cards still in the possession of the original owner.”

This implies that no card fraud incidents verified by UK Finance are a result of details being skimmed from a contactless card.

To mitigate the risks involved with fraud (a problem that has always surrounded banking methods), review the section below...

Alternative views have been suggested by Which? and certain RFID-blocking technology providers, who suggest it is possible to skim enough details from a contactless card to make fraudulent online purchases.

How do I avoid contactless card fraud?

Keep your card to yourself - it is yours and yours alone. No lending it out to a friend.

Don’t let your card out of sight (even if a cashier insists).

Don’t hand your card to a cashier for them to tap.

Check the amount on the terminal or till screen before tapping.

Request a receipt for each purchase.

If you suspect your card has been lost or stolen, report it to your bank immediately (also report it to Action Fraud).

Change your PIN regularly (you can do this at most ATMs).

Consider a specially designed sleeve or RFID blocking device for added protection.

Keep an eye on your bank statement and remember that not all contactless payments will show online straightaway.

The advantages of contactless payments?

Contactless payments are the fastest and most convenient way to pay for small purchases.

You only need to enter your PIN after every five contactless transactions.

Contactless cards are just as secure as Chip and PIN cards.

Mobile contactless payments often come with an extra layer of authentication (like Face ID with Apple Pay) - allowing you to essentially use your face instead of a PIN. This also means you can pay for purchases over the usual contactless limit of £45.

All your contactless purchases are tracked on your statement.

Mobile contactless payments are also tracked in your payment app.

The disadvantages of contactless payments?

Your contactless payment can be rejected without an explanation (but you can usually then just pay using Chip and PIN on the same card).

There is a limit to what you can spend per transaction using contactless (but, again, you can use Chip and PIN on the same card for larger purchases).

Not all retailers accept contactless payments (again, you’ll likely be able to use the same card to process a Chip and PIN payment instead here).

There is a limit to the amount of consecutive transactions (five) you can make before needing to verify your identify with Chip and PIN.

It is possible for fraudsters to use technology that remotely reads certain details from your card (see above section on security for more information).

There is a chance of “card clash” on the London Underground if you present multiple cards at once.

Start taking contactless payments

If you’re a business owner that wants to enable your customers to pay contactless, you’re already in the right spot.

Find out more with our contactless card machines page here.

Would you like

a callback?

FIND OUT MORE

Talk to an advisor today...