How to start using a card payment machine for your business

Our complete guide to card payment machines will how you how to set up card payments, which machine to use, the benefits you’ll get, and why you need to adapt to changing payment methods

Quick Links:

> Understanding changing payment habits

> The benefits of using a card payment machine

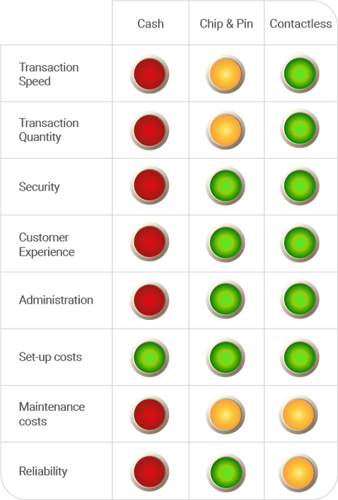

> Cash vs Chip & PIN vs Contactless

> Choosing the right card payment machine

> Are card payment machines secure?

> What fees will I pay for using a card payment machine?

> Leasing or buying your card payment machine

> Why do I need a merchant account for my card payment machine?

> How card payment machines can future proof your business

> Choosing the right card payment machine supplier

> Case Studies / customer testimonials

Understanding changing payment habits

519 million transactions were carried out using a card payment machine in UK businesses in June 2020.

That’s a huge increase from 43.5 million in 2015.

It seems like only yesterday that we were saying farewell to mag-stripe cards, and adapting to the use of Chip and PIN.

Before that, cash was king for decades.

Cash lost its crown in 2019 when card payments using debit and credit cards officially became the predominant payment option.

2020 has encouraged an even more rapid acceleration towards cards and contactless payments.

Consumers who had never paid using card before have started to.

And have become comfortable with it.

With consumer payment habits changing, has there been a better time to start using a card payment machine?

The benefits of using a card payment machine

The shift towards card and contactless payments is reason enough for many businesses to invest in a card payment machine.

But, there are additional commercial benefits you’ll experience by accepting card payments.

- Safe & secure payments

Remove the risk of accepting fraudulent bank notes and coins. A card payment machine creates a transparent audit trail of all your transactions so you know exactly what you’ve taken during the day. Plus, with reduced cash on-site you’re improving your store security too. - Serve customers quickly

There’s no need for your customers to hang around while you count change. With a card payment machine, they can simply tap and go. Even entering a PIN number is quicker and easier than counting cash. - Hygienic payments

Handling large amounts of cash wasn’t ideal before covid came along. However, since the outbreak in 2020 many prefer card, as it reduces the risk of contracting the virus between customers and staff. - Card payment machines reduce cash handling by providing a simple and contact-free way to pay.

- Serve more customers daily

Keep queues moving and serve more customers on a daily basis. The more customers you serve, the more transactions you can potentially make. Meet customer expectations and provide a simple and fast way to pay.

Want to find out more about the benefits of using a card payment machine? Read this.

Cash vs Chip & PIN vs Contactless

Have you ever looked at the way your business accepts payments and considered all the different things involved, and how accepted a different method of payment could benefit your business?

Chances are there’s always going to be a mix between cash, Chip & PIN and contactless.

But let’s set it out simply and compare, which payment type can really help you start accepting payments quicker, and more securely.

Cash

Cash is historically the main way to make payments in store, but no more.

Compared to more modern payment methods it’s slow and open to security risks for businesses in terms of fraud.

In truth, it always has been slow and open to fraud, but before there were no other options.

Cash comes with a lot of admin; cashing up at the end of the day, making deposits at the bank, and lacks an audit trail of payments.

And it limits impulse purchases, as customers are limited to whatever’s in their wallet. Plus, it’s not the most hygienic.

Chip and PIN

After mag-stripe payments (the old method of swiping and signing), Chip and PIN presented a revolution in payment processes.

At the turn of the century, it was classed as the “modern” payment method, but less so now.

It’s still faster and more efficient than cash, plus Chip and PIN is safer for customers and businesses alike.

Payments are only authorised when the customer has the funds in their account.

So you can rest easy about payments not showing up in your account.

If the customer doesn’t have the money in their account, the transaction doesn’t go through.

Chip and PIN is a vast improvement on cash payments but has been overtaken by contactless in recent years.

Contactless card payments

2020 has been the defining year for contactless payments.

Shoppers who were already using it often now rely on it completely.

Those who still used cash or Chip & PIN have seen the benefits of contactless as the fastest and most hygienic way to pay.

They’re more comfortable with the idea of “tap and go” payments and say they’re unlikely to go back.

Contactless payments are the most efficient way of accepting payments.

Customers simply tap their card, and move on.

Like Chip & PIN, payments are only authorised when the customer has funds in their account. If they don’t, the payment won’t go through.

There’s no risk to you.

More than that, new contactless card payment machines can accept payments from all major debit and credit cards, along with digital wallets like Apple and Samsung Pay using smartphones and other mobile devices.

Contactless technology is constantly developing and is set to be a major player in the card payment market in years to come.

Choosing the right card payment machine

Once you’ve decided to invest in a card payment machine for your business, you need to choose the right one for you.

This depends on a couple of things:

- Whether you only need to take payments in one location

- If you need to accept payments on the go

- If you take payments to the customer

- If you need a mix of all three

There are three types of card payment machine to choose from:

Countertop card payment machine

Do you have a single point of purchase in your store, such as a till point? This is the perfect machine for you. Simple to use, a static machine provides card payment solutions at affordable prices.

Portable card payment machine

Want to let your customers pay at different locations on your premises? Portable card machines are the answer. They’re ideal for hospitality venues operating table service or large department stores.

Mobile card payment machine

Do you need to take payments on-the-go? Perhaps you do business at conferences or trade shows. You’re a tradesperson or market trader? A mobile machine allows you to take card payments, wherever you make a sale.

Are card payment machines secure?

Some businesses are wary about card payments and their security.

This is just one of the many myths about card payment machines.

Contrary to what you might think, using a card machine in your business is actually one of the most secure ways to accept payments.

Especially when you compare it to accepting cash and the risk you run of unknowingly accepting counterfeit notes and coins.

Plus, keeping large amounts of cash on the premises puts you at risk of theft.

All transactions made using a card machine are approved at the point of purchase.

If the customer doesn’t have the funds to cover the transaction, it doesn’t go through, and you get an instant notification that the payment failed.

You have an automatic audit trail of your payments received into your account, so you have 100% certainty what payments you’ve taken, and where they’ve come from.

From a technology standpoint, card payment machines work in tandem with the technology built into payment cards (and payment technology built into modern smartphones) to ensure all transactions are safe and secure.

You can read more about card payment machine security here.

What fees will I pay for using a card payment machine?

One thing to be aware of with using a card payment machine, is the fees that you’ll pay as part of the investment.

You need to be wary about your fees, because some suppliers will keep some of these hidden and you’ll only find out about them when you get your first bill.

Rest assured, if you choose Handepay, we’re 100% up front and honest about the fees you’ll pay from the start.

You’ll be in the know about everything you’ll pay before signing on the dotted line.

Unnecessary fees to look out for include a minimum monthly service charge and PCI DSS compliance (and non-compliance) fees.

For a full breakdown of the fees around card payment machines, read this blog about the hidden costs of choosing a contactless card reader.

Leasing or buying your card payment machine

The next question you have to ask is whether you want to rent or buy your card payment machine.

In reality, very few businesses decide to buy their card machine outright.

The main reason for this is the cost and ongoing support.

Buying a card machine that can accept all major forms of card and digital payments is expensive.

Plus, you’ll be completely liable for repairs and replacements if something goes wrong – possibly leaving you without a card payment solution while you’re organising a fix.

You also have to negotiate fees on your own, which means you won’t get as good a deal as you would with a card machine provider.

Because specialist providers - like Handepay - serve hundreds of clients, we’re able to negotiate better rates, which we can pass on to you, saving you money.

Want to get more information about the fees that come with card payment machines? Take a look at this.

Why do I need a merchant account for my card payment machine?

If you want to start taking card payments for your business, then you’ll need to get a merchant account.

There’s no way around it. You have to have one.

Your merchant account is an important part of the card payment process, where your funds are held until they’re settled into your business bank account.

It’s easiest to organise a merchant account through a dedicated merchant services provider like us. We’ll be able to organise a merchant account and the best card payment machine in one handy package for you.

Find out about merchant accounts, and the steps to start taking payments, in our article here.

How card payment machines can future proof your business

Having a card payment machine used to be a way to stand out from the competition.

While other shops were making customers stand in long queues while accepting cash transactions, you could fly through transactions as customers quickly paid and moved on.

Today, having a card payment machine is considered essential for most businesses.

More than half of your customers now expect to pay using contactless.

Some will be paying using a debit or credit card.

Others will be paying with a smartphone or tablet, others will pay using a smartwatch or other device.

Either way, those wanting to pay by cash are quickly declining.

By 2028 it’s expected that debit card payments will reach about 22 billion annually.

Roughly two thirds of UK customers now use a digital wallet synced to their smartphone.

Everywhere you look, the way we pay for things is changing.

Consumers aren’t showing signs of returning to cash payments.

In fact, cash is in such stark decline that calls are being made for protections to be put in place to protect those dwindling number of consumers who still rely on it.

Of course, customers who rely on cash should be able to use it. But if you look at the future of payments, we are moving ever more towards contactless.

Acting early and introducing a card payment machine capable of handling these payment types is essential to future proof your business for tomorrow’s payment landscape.

Choosing the right card payment machine supplier

Finally, you want to be sure that you choose the right card machine provider for your business.

We’ve already discussed the risks around hidden fees and not understanding what you're signing up to.

That’s one consideration when choosing a card payment machine supplier.

There are other things you need to consider.

- The support you’ll get (and the availability and quality of the support)

- Access to upgrades

- Ongoing service and rates

We make accepting card payments affordable and hassle-free. Whether you’re new to cards or just getting started, joining Handepay is a breeze.

If you already accept card payments, why not take the Handepay Price Challenge?

If we can’t beat your current costs, we’ll give you £1,000.

It’s that simple! Click here to take the challenge and find out how much you could save.

I was shocked to discover that I could save £74 per month by switching to Handepay!

The Archer, Manchester

I saved over £600 on card processing fees by switching to Handepay!

Belinda Wood, Bella Knit, Corby

I saved over £4,000 per year by switching to Handepay – more than £140 per month on PCI DSS fees alone!

Sheri Food Store, Peterborough